September 29, 2016 – Transferring money from one big bank to another, and from one currency and country to another currency and country should get a lot easier in 2017. Yesterday when my wife went to her bank to request to send a wedding gift of 200 Euros to a friend in France, she was told it couldn’t be done and that it would be better to just write a cheque in Canadian currency and send it. When received the recipient would then take it to the bank where it could be held for as much as a month before the funds would be released in equivalent local currency which is the Euro.

How ridiculous.

This may come to an end in 2017 as many banks around the globe adopt Blockchain technology faster than expected according to IBM which has produced a report entitled Leading the Pack in Blockchain Banking: Trailblazers Set the Pace. IBM’s Institute for Business Value combined with the Economist Intelligence Unit did a survey of 200 banks from 16 countries asking them their expectations about blockchains. Currently only a small number of banks have adopted the technology largely in pilot projects. But the survey shows that a number of banks intend to use it for retail payments and consumer lending, trade finance, corporate lending and reference data.

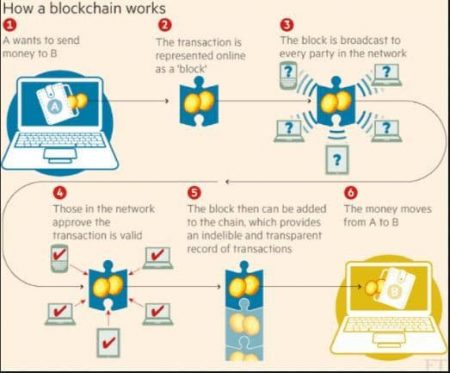

What is blockchain?

Originally designed for the handling of transactions using digital currencies such as Bitcoin, blockchain is becoming an effective way to digitally track all kinds of currencies and other assets. Blockchain is a way of structuring data. Using it you can create a digital ledger that can be distributed across a network of computers. Blockchain provides a secure method for transactions because it uses advanced cryptography.

Blockchain doesn’t require a central authority as a point of validation for any transactions using it. A transaction that gets recorded in the blockchain ledger can be added to by network participants. When added the new information is evaluated and validated by all members. It then becomes an additional block added to the chain.

In a February 2016 article appearing in The Wall Street Journal, Steven Norton describes how a company would use blockchain. He writes:

“Assume an organization has 10 transactions per second. Each of those transactions receives its own digital signature. Using a tree structure, those signatures are combined and given a single digital fingerprint — a unique representation of those transactions at a specific time. That fingerprint is sent up the tree to the next layer of infrastructure, such as a service provider or telecom company. This process happens for every organization in the network until there is a single digital fingerprint that encompasses all the transactions as they existed during that particular second. Once validated, that fingerprint is stored in a blockchain that all the participants can see. A copy of that ledger is also sent back to each organization to store locally. Those signatures can be continuously verified against what is in the blockchain, giving companies a way to monitor the state and integrity of a particular asset or transaction.”

In yesterday’s edition of Fortune, Lucinda Shen, writes that IBM is predicting 66% of banks will be operating using blockchain for commercial operations. She describes successful tests of blockchain for bond transactions and cross-border payments by eight different banks.

The embracing of blockchain by banks is seen as a way of reducing costs and speeding up transactions by cutting down on time to reconcile disparate data such as trying to send a money gift to a couple getting married in France from here in Canada without going through the hoops I described above.