May 12, 2016 – Cloud computing, that is the recording and saving of data on Internet-based servers is today mainstream. Accounting, banking, word processing, data storage, all no longer require a user to manage a computer system or local area network with large data and storage servers. For small business the ability to use the cloud represents the democratization of software technology. What was only available to companies with deep pockets is now accessible to business startups buying subscriptions to highly sophisticated software algorithms. Software can originate from anywhere and data can be saved anywhere. As long as appropriate levels of security are in place, information in the cloud is as safe as that stored on a local hard disk drive.

In Part 1 of this series we will look at the arrival of one of the most intriguing and disruptive innovations in the data world, blockchain. Blockchain is the technology behind digital currencies of which the most noteworthy is bitcoin. Its arrival is sounding a sea change in the purpose of the Internet, from a keeper of information to the central hub for global finance.

For years I have used PayPal to send out payments for things I purchase and receive money from work assignments. But PayPal is nothing like blockchain. You don’t see banks lining up around PayPal as a technology. But they are very much aware of just how blockchain is altering bank payment systems globally. The nature of money and financial transactions are about to be altered forever. In twenty years will we be talking dollars, Euros and pounds? If we are they will be e-dollars, e-Euros and e-pounds, digital forms of the currencies with which we are currently familiar.

So what is blockchain?

It is described as a global distributed ledger that is accessible to anyone for managing value. Value can be money, stock, bonds, property titles, deeds, art, scientific discoveries, patents, intellectual property and more. Blockchain provides a secure means of moving and storing value. In a recent article appearing in The Report on Business in The Globe and Mail, Alex Tapscott describes the first generation of the Internet as a primary digital information repository. But blockchain is a child of the second generation Internet. Tapscott describes its function as follows: “It acts as ledger of accounts, database, notary, sentry and clearing house, all by consensus.” He continues, “And it holds the potential to make financial markets radically more efficient.”

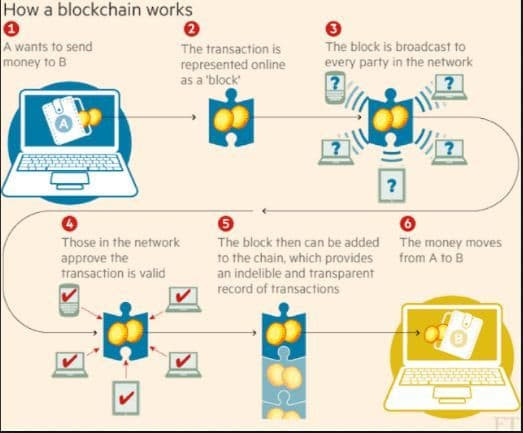

In the diagram below produced courtesy of Britain’s Financial Times, the blockchain process of a bitcoin transaction is illustrated.

In his annual speech to lawmakers in the United Kingdom, Mark Carney, Governor of the Bank of England, described how global central banks should begin openly experimenting with blockchain to handle digital currencies. Known as cryptocurrencies, bitcoin and others have emerged as a parallel financial system designed to speed up and secure value transactions. Carney stated, “The great promise of distributed ledgers for central banks is their potential to enhance resilience. Distributing the ledger means multiple copies of the system. It can continue to operate if parts get knocked out. That removes the single point of failure risk inherent in a centralized system.”

Carney sees blockchain as a more efficient way to handle private sector payments and the settlement of securities. The Governor as a result indicated that the Bank of England is opening up an incubator to encourage the development and integration of what is referred to collectively as fintech, applications designed to support blockchain and deliver a wide range of financial services that today, more often than not, bypass traditional banking.

Carney isn’t the only governor of a state bank who sees blockchain as a game changer for banking globally. Chair of the U.S. Federal Reserve, Janet Yellen, at a recent three-day event involving the World Bank and International Monetary Fund indicated that “she gets it.” In a brief statement she described blockhain technologies as “capable of providing the Fed and other regulators with the next generation tools to fulfill their mission of monitoring the safety and soundness of the financial system more effectively.”

So what does blockchain mean for business?

- a method of money transfer that directs funds to recipients across borders instantly eliminating high transaction fees

- a secure and inexpensive way of doing business without paper.

- a faster way to manage trades, issue credit card debt, transact bonds and other securities assets

- a more efficient way for entrepreneurs to receive new venture capital, issue IPOs and finance major projects

- an easier way for regulators to scrutinize corporate financial activities

New fintech apps designed to use blockchain have been siphoning money away from banks in recent days. That’s why a number of large banks have formed the R3CEV Consortium to incorporate fintech into banking. The outstanding issue for banks is “will blockchain scale?” When it was handling bitcoin and a few other cryptocurrencies the transaction volume was small. But blockchain applied globally to financial markets would be dealing in millions of transactions and the equivalent of trillions of dollars.

Mark Andreesen, the coauthor of the first Internet browser, Mosaic, predicts within 20 years “we’ll be talking about blockchain the way we talk about the Internet today.” Think about it, if someone at the dawn of the Internet, not thirty years ago, had predicted we would one day see cloud-based technology giving banks a run for their money he or she would have considered the notion absurd. But not anymore. Blockchain is disruptive and transformational and when central bankers from 90 countries and 45 banks get together along with companies that form the backbone of the Internet like IBM, Microsoft and Cisco, you can be assured that blockchain is well on its way to becoming the financial exchange application standard. Finance and value have not seen anything like this since the instituting of the gold standard.