This week’s headlines look at a new surgical robotic device for minimally invasive procedures, problems in shale gas production in the U.S., the dramatic drop in the cost of solar energy technology, the battle to end mountaintop mining, and India’s ambitious road map for space exploration. As always I encourage you to comment, ask questions and provide input on topics I write about or feature. And should you come across an interesting technology or scientific breakthrough that you feel should be included in this blog please don’t hesitate to let me know. Enjoy the read!

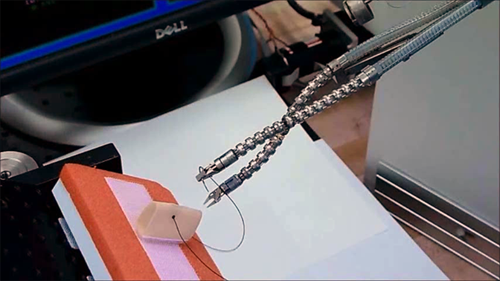

Biomedicine Update: New Insertable Robot to Enhance Minimally Invasive Surgical Procedures

The Insertable Robotic Effector Platform, IREP for short, seen in the picture below, has been licensed to Titan Medical, a Canadian company focused on advancing robotic surgical technologies. An invention coming out of a collaboration between Columbia and Vanderbilt Universities in the United States, the IREP is the world’s smallest single-port surgical robotic device capable of performing laparoscopic procedures. IREP has two arms, a 3D vision system that has two controllable miniature cameras that provide real-time visual feedback for surgeons. The robot arms look like miniature snakes and the device can be easily mounted in a surgical suite because it is much smaller than other surgical robotic tools.

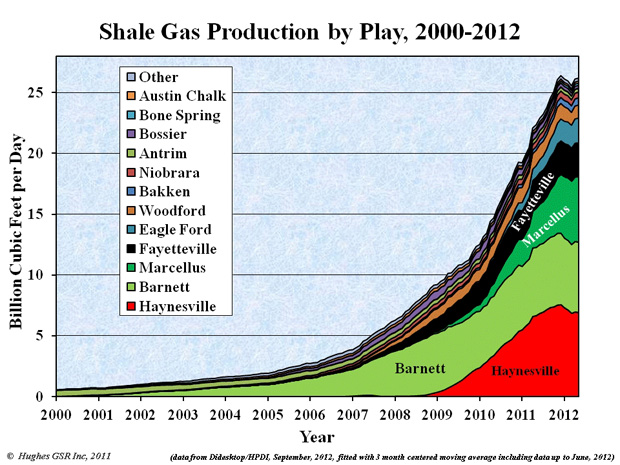

Energy Update: Is Shale Gas Production a Bubble Ready to Burst?

One of the knocks on fracking has always been the quick depletion that seems to happen soon after a new gas or oil well is drilled. In the U.S. it seems that shale gas has reached a plateau and that the 100-year supply may prove to be an inaccurate assessment of what can be forced out of the ground through fracking. The U.S. today uses 24 trillion cubic feet of natural gas per year. Based on current proven reserves including fracked fields there may be less than 20 years of reserves if consumption remains flat. Shale gas production in the U.S. earlier this year was at 27 billion cubic feet per day. But that production has leveled even with new fields coming on stream. Part of the problem goes back to my first comment. Shale gas well production tends to drop by 50% or more after the first year. As fossil fuels go, gas is the cleanest, but the United States may not have the grace period it has been talking about if these fields continue to encounter significant production drops. Either the technology improves to bump up yields or alternatives will have to be found to meet future energy demands.

Energy Update: Solar Costs Going Down

How much has solar energy technology gone down in cost? In the last two years solar has gotten 60% cheaper. Compare that to wind which has seen the technology reduce its costs per Kilowatt by 15-20%. Why is solar getting cheaper? Because the cost of solar panels continues to drop while the conversion efficiency of photovoltaics continues to improve. That means smaller panels can yield more energy. In August, residents in Boston were told they will pay less for electricity produced from solar than from other sources under a program called Solarize Massachusetts. Is cheaper solar rates a reflection of the drop in the cost of solar technology? Yes and No! Massachusetts is implementing cheaper solar electricity rates to encourage more clean energy investment in the industry. What is surprising is the cost of producing solar is appearing to be competitive with non-renewable alternatives.

Mining Update: Ending Mountaintop Mining for Coal a Priority of the EPA

Of all mining practices in Appalachia mountaintop mining is the most environmentally destructive. Yet the coal industry continues to push to get permits to blow off the tops of mountains to expose seams for excavation. What mountaintop mining continues to do is destroy natural habitats and wildlife, change the course of mountain stream and the quality of water in them, pollute valley bottoms with tons of debris, and introduce chemical toxins into wells and drinking water sources. That is why the Environmental Protection Agency in the United States is trying to reverse a permit originally awarded to Mingo Logan in 2007, a subsidiary of the second largest coal producer in the U.S., Arch Coal. It is interesting when you visit the Arch Coal website and read the page on “How We Mine” you don’t see any examples of mountaintop mining practices. I guess it wouldn’t give them an environmentally responsible look. And when you read the company’s vision although they use the phrase “environmental stewardship” it takes on a whole new meaning when you see one of their mountaintop mines in operation or look at the level of selenium in local water supplies.

Space Update: India Joins the Space Race with an Ambitious Set of Missions

In 2008 India successfully launched its first unmanned lunar probe, Chandrayaan-1, placing a satellite in lunar orbit and hard landing a probe on the Moon’s surface. It received very little notice here in North America but it established India as a space faring nation. Today the Indian Space Research Organisation, or ISRO, is expanding its exploration of near-Earth and deep space with 58 space missions planned for the next decade and beyond. Missions include sending robot to land and explore the moon, an Indian-made global positioning satellite network called IRNSS, new satellites for communication, Earth observation and imaging, solar observation, studies of extra-solar objects, all to be launched with a new family of rockets capable of deeper space missions and heavier payloads. In 2013 India will launch its first mission to orbit Mars. And last but not least, India intends to join the U.S., Russia and China with its own human space flight program. “Baaharee duniaayaa” is Hindi for “outer space” and India intends to take a leadership role in the 21st century.

A Postscript

Once again I have to thank the many thousands who continue to visit 21st Century Tech Blog each month. Lots of you have become subscribers which is great. Keep on sending me your questions and comments. They inspire me to investigate and report back with even greater diligence. Let me know if there is a topic, not yet covered by 21st Century Tech blog that you would like to see. If you have written an article that fits within the themes of this blog then let me know. Guest articles are welcome! And thank you again for continuing to drop by.

– Len Rosen

Len: I’m new to your Blog, and like it very much. Do you know about:

V3Solar | The Most Efficient Energy Under The Sun

v3solar.com/

V3solar is a USA company with its Head Office in Los Angeles, California and its R & D laboratory in Ashland, Oregon. V3solar has invented, and is now in the …

Hi Tom, I wrote about V3 Solar last week. See https://www.21stcentech.com/headlines-at-21st-century-tech-for-october-12-2012/. The weekly headline reads “Energy Update” Rotating Solar Panels – Net Result Lots More Energy Yield – Who Would Have “Thunk” It?”

<>

Solar doesn’t seem very economical for true off-grid applications, even if the panels are free. That’s because energy storage costs are still mostly too expensive. But, when a utility power grid absorbs all excess output and the panel owners get credit or cash for the energy pumped into the grid, free or low-cost panels could be real moneymakers. Not only would the owners get free electricity, they would get free money to purchase grid power after sunset and to install more cheap panels. The key to solar power feasibility is cheap “storage,” which a utility grid provides.

Private off-grid power is a completely different condition. I stumbled across a fascinating hydro-power blog site last week that seems dedicated to selling for $1.8-million a 400 kW (rated nameplate capacity) hydropower plant, 50-acres of land, and 4000 square feet of underground “residence” located near Spokane in NE Washington state. Apparently the utility grid must purchase any and all excess power at a price near a nickel kWh. If enough water flow is available, the two hydro turbine generators produce $20/hour. Since a year has 8,760 hours, the site could in principle produce $175,000 worth of power income annually. I’m guessing not nearly enough water flow is available to keep both turbines humming 24/7/365, but often a lot of surplus flow must bypass the installed turbines. Pictures of the site show lots of “wasted” water cascading down a scenic waterfall upstream of the turbines. The service factor of the 400 kW of installed generators may be as low as 10% of nameplate capacity due to seasonal water flow variations. See: http://deepcreekhydro.blog.com/2010/01/17/hydroelectric-plant-for-sale/

There are loads of great color pictures of the hydropower site at: https://plus.google.com/photos/106788585722120874733/albums/5419718005012461377?banner=pwa&gpsrc=pwrd1#photos/106788585722120874733/albums/5419718005012461377?banner=pwa&gpsrc=pwrd1

It takes a lot of water to produce a single kWh of energy. For example if a 75% efficient hydroturbine generator has a 60-foot head of water (~25 psi), ~ 1,000 cubic feet of water must discharge through the turbine to produce one kWh of electricity. Seems doubtful that an individual would find it feasible to dam a stream and “store” significant hydropower in his own private reservoir. Like private solar panels that use the utility grid as the “storage” mechanism, private hydroturbines must harvest the waterpower when it’s available, and immediately transfer the excess power into the utility grid. But just for residential usage, a small stream might flow 24/7/365. The linked Deep Creek Hydropower blog shows two turbine generators. One is rated 250 kW; the other is 150 kW. Apparently the smaller generator runs constantly to supply the residence; when excess water flow is available, the larger 250 kW hydroturbine generator starts up to provide an additional $300/day income. One wonders if many such potential sites are scattered about the country. Do the utility regulations in Canada require the utilities to purchase electricity from private hydropower?

I’d like to see your tech blog give us a numerate treatment of small private hydroelectric systems. How much do small turbines and generators cost? How many feasible sites are there? Can cheap centrifugal pumps serve as low-efficiency low-cost “turbines?”

Anyone who supposes shale gas is a temporary bubble about to burst needs to study Ryan Duman’s analysis:

http://services.lib.mtu.edu/etd/THESIS/2012/Business&Economics/duman/thesis.pdf

This study shows NG gas prices as low as $3/mcf produce on average at least 10% returns/annum for 20-years on fractured shale gas wells. That would seem sufficient inducement for the NG industry to keep on drilling new wells as long as prices are at or above $3/mcf. The study also shows the well operators get a $0.70 “administration” fee on every mcf produced. Since the average well might produce over 5-million mcf over its 20-year lifespan, the “administration” fee alone eventually rewards the operators with $3.5-million for each well completed. Most of that comes in the first few years.

I don’t believe that the argument about shale gas is that it is temporary. The argument is that shale gas extracted from fracking provides diminishing returns from each well that is drilled after a very short period of time, which means more drilling and fracking to maintain total volumes delivered to the market.

I don’t see the problem. The US natural gas industry has capacity to drill and complete about 4,000 shale gas wells per year. On average each well will produce about 2.5 Bcf in its first year. Total first year production from the 4000 new wells would be about 10,000 Bcf; coincidentally the same 27 Bcf/day your article cites as daily shale gas production. Should be obvious that after drilling some 20,000 additional wells (over the next 4-years), residual production from all the older wells in gradual decline will equal or exceed flush production from 4,000 new wells. The major natural gas industry problem is how to prevent the potential production glut from driving prices below “breakeven;” about $3/mcf. In the NG business “breakeven” on a single well means $3.5-million “administration” costs, plus 10% annual return on investment. The link I posted shows $3 mcf wellhead prices produce “breakeven” revenues totaling $13.5-million per well for the operators. The average cost per completed well is about $8-million. $5.5 million return over 4-years on a $8-million investment sounds very attractive.

The only “bubble” I see is rising drilling/completion costs because of the limited capacity. The drilling /completion capacity is unlikely to expand much because the logical forecast for the next several years is overproduction will glut the market and drive prices down below breakeven, at which point drilling will either greatly diminish, or else drilling/completion cost must fall dramatically so that lower NG prices will be high enough to create breakeven revenues. Drilling/completion companies aren’t going to make major capex commitments with the expectation that drilling demand is going to fall off. Looks like traditional supply/demand market forces will do a fairly even job of regulating both prices and production of shale gas.

I am less optimistic than you about the capacity to continuously drill while ensuring all environmental risks are properly addressed. We have seen fracking trigger minor earthquakes in relatively low incident earthquake zones in the Midwest. While I’m pretty confident that we have the means to ensure that we can eliminate potential groundwater contamination issues by selecting drilling sites that geologically separate shale oil and gas from aquifer-bearing rocks above, I’m not sure that those doing the drilling can be trusted to do the right thing every time so that accidents don’t happen.

The drop offs that occur in shale gas fields are not comparable to what happens in more conventional oil and gas formations. The yield decline when compared is dramatic because what occurs in decades in conventional fields occurs in months with fracked sites. So this self-sufficiency drive may turn into a “drill baby drill” engagement that leads to diminishing returns.

And here is my rant in response to your comment. By far the better approach to meeting energy demand involves improvements in the technology we use to meet our lifestyle needs so that our devices use less energy. And very much at the top of the list of ways to become more energy self-sufficient, is conservation, ending our throw away mentality once and for all. If we can set a goal to eliminate for lack of a better word, the “entropy” that condemns our modern technology into endlessly pursuing new energy sources, we would have a self-sustaining world that gives us the biosphere we have never attained even on microscopic level. I know you know what I am talking about because you have made this point yourself when talking about the challenges we face in sending humans into space. Well the Earth is in the same boat, it is our spaceship.

[…] won’t be ISRO’s first lunar touchdown mission. Chandrayaan-1, launched in 2008, included an orbiter and probe which descended to the floor to detect the […]