January 6, 2018 – My wife and I live off our retirement savings and investments. We both receive a pension and old age security monthly payments from government programs established in Canada. When you are relying on cash flow from an investment portfolio you pay attention to business fundamentals: what industry coverage do you have; what kind of dividends can you earn; and what are the management fees you pay your investment manager for their services.

In the last two years I have asked the bank where my wife and I keep the majority of our investment portfolio to search for green funds that we could consider. I felt it was the least I could do to bring climate change mitigation and adaptation into the conversation around investments. At the time my bank had little to say about green. But that has changed recently with the bank declaring in the investments it manages that it will now look at climate risk. It didn’t answer my need to find a green fund, but it was a first step.

A friend of mine, who is also an investment manager from a competing bank, however, recently suggested my wife and I consider a new green fund, not launched by his own bank, but by a third-party financial institution. Called the BMO Fossil Fuel Free Fund, developed by Bank of Montreal, states that its portfolio “excludes securities of issuers that explore for, process, refine and/or distribute coal, oil and/or gas. The portfolio manager also excludes securities of issuers that produce and/or transmit electricity derived from fossil fuels or transmit natural gas.” In the absence of these types of companies in the mix, the fund focuses on non-energy U.S. and international equities. The performance of this ostensibly green fund within our investment portfolio has been stellar. It has grown faster than any of our other balanced fund investments. And it is an indicator that going green in an investment portfolio makes not just environmental sense, but good economic sense as well.

Behavioural economics that focuses on fighting climate change is a recent phenomenon. Our financial systems remain tragically conservative about moving away from carbon polluting companies that have yielded good returns and dividends over time. But the BMO Fossil Fuel Free Fund is an indicator that need not be the strategy moving forward. That’s because, in the age of climate change, the meaning of risk has changed. It’s no longer about just financial risk. It’s now about the environment.

A new term, Environmental Social Governance (ESG) has entered the lexicon of investment. In addition to pioneering equity-based funds like the one BMO has launched, governments are issuing green bonds to address climate change mitigation and adaptation projects, the rebuilding of infrastructure, mass transportation, and other socially responsible investments.

Bonds are fixed percentage investments, unlike an equity-based fund. They also are fixed term. They are designed to be steady performers, and in the case of green bonds, aimed at meeting ESG standards.

The Climate Bonds Initiative (CBI), an international, investor-focused not-for-profit, is one organization attempting to organize and mobilize the $100 trillion global bond market by tracking green bond opportunities globally. As of the first month of 2018, CBI lists $120.2 billion in bonds that are certified climate and green bonds, either meeting or under review to determine that the investments are CBI compliant.

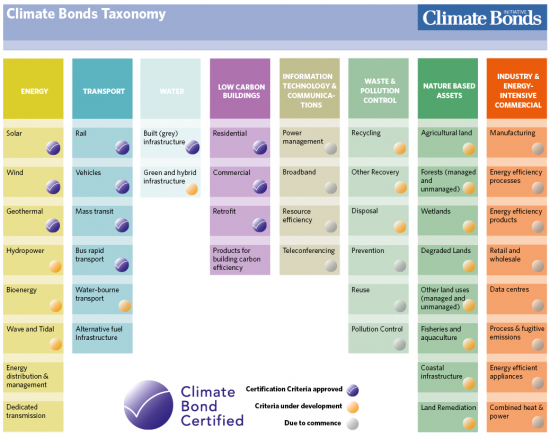

CBI’s aim is “to accelerate the transition to a low-carbon economy by mobilizing the largest capital market of all…for climate change solutions.” By providing expert guidance focused on ESG, CBI has created criteria consistent with Intergovernmental Panel on Climate Change (IPCC) reports that describe technologies and practices where investment is needed to be consistent with a low-carbon economy, and to avoid dangerous global warming. The following chart illustrates the mix of industry segments and categories that currently are developed, being developed, or are in a beginning process to meet ESG and CBI green standards:

As more countries reveal their transition to a low carbon future plans, green bonds will become even more significant as a percentage of the total bond market. The current green portfolios are holding their own in terms of financial returns when compared to traditional bonds. The difference, however, is the moral bonus that comes from making ESG buying decision.

CBI isn’t the only player in the world of green bonds. As of 2017, the total value of these types of bonds has risen to just under $900 billion U.S., with an increase of $201 billion alone in the last year. It seems like a lot but in fact is less than 1% of the total bond market. That means financial managers and investors have a long way still to go to move away from fossil fuels and other unsustainable investment instruments that contribute to the status quo rather than a survivable low-carbon future.

The magnitude of climate change remains poorly understood by far too many providing guidance to investors. Applying the principles of ESG, focused on a climate-resilient future economy, will lead to a positive legacy for those who follow us as the 21st century unfolds.