November 30, 2017 – Moody’s is in the bond credit rating business. It issues ratings on a A to C scale with sub gradations such as Aaa, Baa. Caa or less. Moody’s also adds a numerical qualifier to its ratings so a city, for example, could be rated A3.Governments with poor credit ratings pay higher interest on money they attempt to raise through the bond market. So being on the good side of a Moody’s rating is a desirable thing.

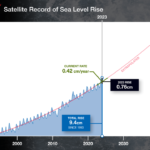

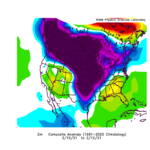

On November 28, 2017, Moody’s gave notice to all U.S. states and local governments that climate change was very much going to be a factor in its issuing of credit ratings for governments. It cited climbing global temperatures, rising sea levels, and mitigation and adaptation strategies as factors it will use in the near future as it incorporates climate trends and climate shock into its rating structure.

Climate trends was defined as change over decades.

Climate shocks were defined as extreme weather events exacerbated by climate change such as severe heat waves, droughts, and floods.

Moody expects governments to develop the means to withstand shocks. For example, for flooding a city would spend tax revenue on infrastructure projects such as strengthening levees, raising the height of berms, reinforcing dams, and removing structures at risk in floodplain areas. States Michael Wertz, a Vice President at Moody’s, “While we anticipate states and municipalities will adopt mitigation strategies….costs to employ them could also become an ongoing credit challenge….Our analysis of economic strength and diversity, access to liquidity and levers to raise additional revenue are also key to our assessment of climate risks as is evaluating asset management and governance.”

In a press release issued to announce this change in its rating policy, Moody’s used the example of Hurricane Katrina and New Orleans (currently A3 rated). It noted that the city’s ratings were negatively impacted by, not only the extensive infrastructure damage to the city, but also by the loss of tax revenue, and the permanent abandonment by a large percentage of its population.

What Moody’s seeks is not just level of exposure to risk from sea level rise, storm surges, intense storms and other weather events, but also adaptation and mitigation strategies. It wants government reassurance, particularly related to impact on economic capacity and activity. Moody’s identified Texas, Florida, Georgia, and Mississippi as states most at risk. No cities and municipalities were mentioned but the credit rater noted that measures like property values, cost of repair for damages, and tax revenue would be areas of considerable interest in determining ratings.

As I stated above, no state or city has yet to see its credit score impacted on the basis of climate risk. But Moody’s is clearly sending a shot across the bow and putting a market value to climate change.

Back in May, Bloomberg published an article by Christopher Favelle, which described how rising sea levels and storm surges along the New Jersey shore was going to impact bond ratings because of extreme weather leading to declining property values, reduced tax revenues, and cost of repairs for Atlantic coastal communities. It sounds like someone at Moody’s may have been reading Favelle’s prose.