The combined past 30-year climate change price tag as reported by Bloomberg Intelligence has almost reached US $7 trillion. The total includes property damage, power failures, wildfires, extreme weather events, insurance premiums and payouts, and more. But along with the cost of climate change, there has been a parallel growth in sectors within the global economy that have contributed to increased GDP. It seems contradictory to have to pay the price for the ongoing damage climate change is doing while watching companies reap profits because they have positioned themselves effectively in this changing world.

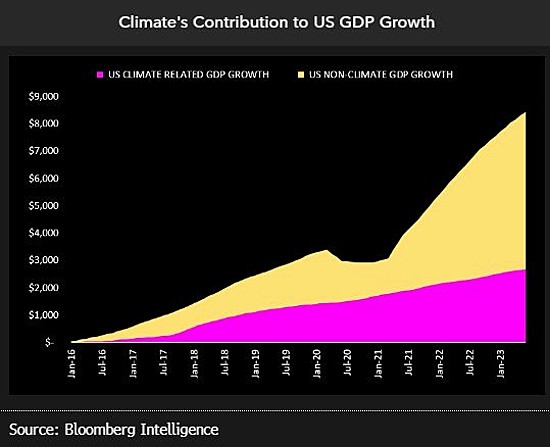

Bloomberg’s ESG climate analyst, Andrew John Stevenson tracks climate change financial impacts. He states that 32% of U.S. GDP growth since 2016 (see graph below) is attributable to economic activity related to repair and restoration for damages and disruptions caused by global warming.

Stevenson has developed a climate damages tracker that calculates the monthly economic impacts of extreme weather events including their impact on consumer credit, insurance risk, new business development, and household spending. The tracker looks at extreme weather events including hurricanes, tornadoes, floods, and droughts and assesses the economic costs.

There are beneficiaries coming out of climate change and its impacts. The following describes who are the winners and why as the world deals with the consequences of anthropogenic global warming.

Climate Change Boosts Adaptation Companies

Extreme weather brought on by climate change is boosting the revenue and profits of home restoration and improvement outlets like Home Depot as well as plumbers and electricians, companies providing offsite storage, equipment rentals, waste removal, and installers of heating and ventilation (HVAC) systems.

Wildfires, more extreme storms and intense hurricanes, sea level rise and coastal flooding are proving to be good for business. In the U.S., if you operate any of the previously mentioned businesses and are located in the states of Texas, Florida and Louisiana, then you likely are making a killing.

Climate Change Mitigation Boosts Companies Bottom Lines

You would think that climate change would cost the economy. Climate change mitigation, however, is stimulating growth for companies touting sustainability and valid green credentials. Two global companies are good examples of businesses enjoying benefits to their bottom lines and share valuation.

Alphabet – Among the leaders benefiting from mitigation strategies is the parent company of Google. In 2007, Alphabet became carbon neutral. It is the largest corporate purchaser of renewable energy accounting for emission reductions equal to 5 million tons of greenhouse gasses (GHGs) annually. It plans to be 100% carbon-energy-free by 2030.

Unilever – This UK-based consumer products company has a Sustainable Agriculture Code and uses 100% sustainable sourcing for 26 of its current brands. The company has reduced GHG emissions by 65% and decreased total waste sent to landfills by 96% since 2008. It plans to be carbon-energy negative by 2030. Unilever is also changing its packaging from single-use plastic to refillable glass, metal and other reusable materials.

There are companies that provide expertise to other businesses and governments and are reaping bottom-line benefits from risk mitigation and planning related to infrastructure and supply chains, hardening businesses, homes, telecommunication networks, the electricity grid and other critical components of the modern economy to deal with climate change impacts. These include companies like Aon, MSA Safety, and Dycom Industries, which are outperforming the stock exchange S&P 500 by 107% over the past decade.

Climate Change Adaptation Boosts Profits for Alternate Payers

Here is a category of bottom-line benefitters you may not have considered. When banks and insurers remove themselves from providing funds or paying claims to those impacted by extreme weather events, alternate sources of money are the beneficiaries.

During the peak period of COVID-19 infections, payday loan providers did brisk business. The same is happening now in the face of climate-change-caused disruptions and damages. Extreme weather events make money for payday providers.

Payday loans are predatory debt traps that prey on low-income earners. But now they are getting customers because of our warming planet. When traditional lenders stop making funds available and insurers cancel policies and deny claims it doesn’t matter what level of income you are earning. The money has to come from somewhere when traditional financial institutions say no.