This week we received, by mail, our latest quarterly carbon rebate from the Government of Canada. The rebate is a tax-free payment that most Canadian families receive if their province hasn’t initiated its own carbon pollution pricing or cap and trade scheme. As a married couple in a metropolitan area in Ontario, the rebate amounts to CDN $210 every three months until April 2025. The total rebate for the year will be CDN $840.

Why get this money to offset the federal price per ton on carbon pollution that shows up at the pump when we buy gasoline or diesel fuel, and that is charged when we use natural gas to heat homes? The federal government recently exempted the carbon price for home heating oil in what appears to be an attempt to shore up political support in an area of the country where the majority of homes use it.

The current price per ton of carbon is CDN $85, roughly US $62, which came into effect on April 1, 2024. Each year the carbon price per ton will rise by CDN $15 until 2030. As the price rises so too will the rebate payments.

Is it unusual for governments to put a levy or tax on fuel? No. In Canada, the federal government collects a fixed excise tax per litre of gasoline and diesel. Provincial and municipal governments also tax gasoline, diesel, natural gas, and home heating oil. For drivers of internal-combustion-engine vehicles, federal, provincial and municipal levies inflate the price of these fuels by as much as 30 to 40%.

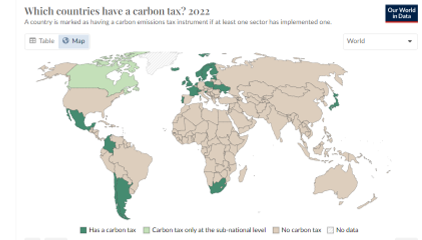

Canada is not alone in putting a price on carbon pollution. Its rebate paid to families, however, is unique. The world map below shows where carbon pricing schemes were in place in 2022.

As you can see, placing a price on carbon whether described as a tax or as a levy, appears to be the exception to the global rule. Note as well that in Canada, marked in the lighter green, carbon pricing and policies vary. Québec, for example, entered into a cap and trade agreement with the U.S. state of California.

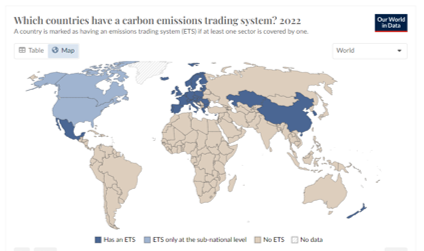

This second world map shows an alternative scheme to reduce carbon emissions using a trading system that popularly goes by the name cap and trade.

To say the least, the policy of pricing carbon pollution is perceived by many to be a tax in my country. Some provinces have challenged the federal government’s constitutional authority to impose carbon pricing. The challenges have failed in court.

The majority of Canadians recognize the need to reduce fossil fuel demand but don’t necessarily understand how pricing carbon pollution gets us to net zero by 2050.

The recent pricing increase in April has caused leaders of provincial, municipal, business, and federal opposition parties to call for a rollback. The leader of the opposition in the federal parliament launched an “axe the tax” campaign.

So how did a market-driven carbon pricing scheme come into being? Its origins date back to the creation of the American Environmental Protection Agency under the Nixon Administration in the 1970s. Offsetting emissions led to regulations to deal with noxious chemicals in the air and water. Companies entered a marketplace with assigned pricing per ton on pollutants like lead, sulphur dioxide, nitrous oxide, and more. The acid rain crisis and the chemical threat to the ozone layer could be addressed by using this market-driven policy to make companies pay for every ton of contributing pollutants and reward others for not polluting.

In the 1990s, the idea of putting a price on carbon emissions using a market-driven scheme began to take hold. The Kyoto Protocol in 1997 included carbon pricing mechanisms within the global treaty. In 2008, the province of British Columbia was the first Canadian jurisdiction to implement carbon pricing and make it revenue-neutral. The federal government adopted the British Columbia approach to reducing carbon pollution in 2019.

Pushback against carbon pricing to combat rising emissions and global warming can produce two results.

The first is to do nothing, to be in utter denial, to act as if there is no carbon problem for humanity to address, that science is wrong, or it’s our fate and God’s will.

The second is to develop an alternate policy like that of the current U.S. administration where a carbon tax has been an unsaleable national program. In the absence of a national strategy before the 2020 election, individual states, 24 in total, had adopted carbon reduction strategies that included pricing carbon, cleaner transportation initiatives, and emission caps.

With the change in leadership beginning in 2021, the federal government in the U.S. passed the Inflation Reduction Act (IRA) and along with other government legislation has produced multiple strategies combining policies, investments, subsidies, and regulations aimed at decarbonizing the entire economy.

The IRA includes initiatives to:

- Create 100% carbon-free electricity by 2035 using programs and subsidies for renewable energy, nuclear power, and the expansion of the nation’s infrastructure to support carbon-free energy transmission.

- Transition to zero-emission transportation by investing in programs to build electric vehicles, an electric vehicle infrastructure, and other clean transportation technologies including sustainable and low-carbon fuels for air and marine transportation.

- Decarbonize existing buildings, homes, and industries through improved energy efficiency in those already built, retrofits, net-zero revisions to building codes, and updates to appliance standards.

- Develop and deploy low-carbon technologies across all industrial sectors including the manufacture of steel, aluminum and cement.

- Invest in direct air capture, carbon sequestration, and other negative emissions technologies that remove carbon and other greenhouse gasses from the atmosphere.

- Promote an agricultural revolution in farming practices that reduce methane emissions, improve land management, and enhance soil natural carbon sinks.

- Change forestry management practices to increase afforestation and reforestation, and implement new land use practices that reduce wildfire incidents.

- Reward research and development focused on demonstrating clean energy and climate technologies that can scale and provide private sector investment incentives to achieve net zero by 2050.

- Incentivize banking and finance to support climate-based carbon-emission-reducing technology initiatives.

Of course, putting a price on carbon pollution could have been incorporated into the mix of such aforementioned policies and practices. In Canada, along with carbon pricing have come many programs similar to those in the U.S. But in choosing carbon pricing Canada has attempted to have citizens participate in the process of tackling carbon emissions and dealing with climate change more directly. Through the market mechanism of carbon pricing, Canadians are either buying in or not.

Of the two strategies, the market-driven one or the regulatory one, which is preferable?

A majority of economists believe carbon pricing is more effective to decarbonize and combat climate change. Assigning a cost to carbon in the form of a tax or levy, or in creating carbon trading markets, polluters, in their best interests, find ways to reduce emission exposure. That’s not to say that combining carbon pricing, regulations and subsidies doesn’t have merit, particularly in targeting specific sectors of the economy.

The majority of economists ascribe to a balanced strategy that includes efficiency and equity. Efficiency comes from carbon pricing using market forces to reduce emissions. Equity comes from rebates to households that offset the disproportionate impact of carbon pricing on those earning a lower income.

Finally, regulations and subsidies when applied to individual economic sectors spur investments and innovation in emission-reduction technologies.

So carbon pricing almost a decade later in Canada remains a good idea that maybe needs a better sales pitch.