The Economist two weeks ago published an issue of its news magazine with the cover artwork seen above. Within the issue was a special report on ESG Investing entitled “A broken idea,” it pointed out that the E, S, and G are truly separate notions and that combining them to create a “feel-good” moment for investors is not solving the existential crisis we face which is climate change.

How do you measure a company’s worth based on three very different issues lumped together? That’s the question Vivek Ramaswamy posed in his book “Woke, Inc.” describing how companies pat themselves on the back for dabbling in the three categories of the acronym without achieving the sustainability outcomes the planet needs.

If you are not familiar with the acronym, ESG, it stands for the measure of:

- E = environment – addressing a company’s approach to climate change and environmental sustainability in all its operations including its supply chain.

- S = social – addressing a company’s policies and actions related to racism, sexism, workers’ rights, and larger global social issues.

- G = governance – addressing corporate leadership, the makeup of a company’s executives, boards, processes and standards for decision making, programs in place for corporate advancement, and shareholder engagement.

Ramaswamy is a self-described “traitor to his class.” He has established companies worth billions, was CEO of a biotech firm, a hedge fund partner, and is a trained scientist who graduated from Harvard University, and who has a law degree from Yale. So maybe he has an insider’s perspective on ESG as a measure of performance that shareholders and the public can get behind.

Ramaswamy in his book argues that those running for-profit businesses may be well-intentioned in embracing ESG, but consensus on how to weigh and balance the three attributes is troublesome. For investors who want a portfolio that reflects sustainability, the best one can say is that it is a source of confusion.

Why is that? Governments are abdicating responsibility. Instead they are relying on organizations like the Securities and Exchange Commission, the U.S. body that monitors corporate performance as it pertains to stocks, bonds, and fiduciary behaviour. In March of this year, the SEC released its guidelines for addressing just the “E” in ESG. The proposed rules fill 490 pages. The European Union (EU) and the European Commission are still wrestling with establishing financial filing standards around the “E” for the 27 nations that form the bloc.

On a personal note, as an environmentalist, I’ve been wrestling with our family investment portfolio which in retirement needs to sustain us since our monthly income comes from dividend payments. It has taken several meetings with our family financial advisor to identify a group of funds governed by ESG principles. The problem, however, is ESG principles are a work in progress.

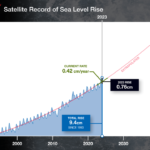

I would be lying to state I’m not selfish in looking at how and where our money is invested. But like a growing number of investors concerned with environmental issues, we want a full picture as shareholders with trillions of dollars in savings invested. We want an “E” road map and an easy-to-understand score card to assess a company or a fund’s progress in addressing greenhouse gas emissions.

Many environmental activists argue that the biggest climate change threat on the planet today is capitalism. Many believe that ESG compliance and rules and guidelines established by organizations like the SEC and EU will lead to “greenwashing,” the pejorative derived from “whitewashing” that describes companies spending more on public relations and advertising green credentials than actually achieving emission reductions and sustainability in practice.

The Economist in its July 23rd report concludes that ESG may be well-meaning but is “deeply flawed.” Equally flawed is ESG scoring. How and who are the scorers?

Some time ago the business world established standards for credit scores. These are scores that measure a person’s credit worthiness. They are based on well-documented financial histories that look at an individual’s credit card debt, payments, defaults, mortgages, lines of credit, banking information and publicly accessible financial flow data. Look up a credit score on Equifax, Transunion, or one of the many other companies that provide scoring, and the results from all tend to be almost identical, in fact, as The Economist article states, having “a 99% correlation across rating agencies.”

ESG scores and ratings don’t come close. As I was researching this posting I looked up a top 100 list of companies rated by ESG performance. It provided a composite valuation based on weighing various ESG scorers’ results. It was easy to see how much variance there was in scoring leading to the list providing a composite score. The Economist report reinforces this observation noting that ESG scorer “ratings tally little more than half the time.”

So for me and other investors looking for ESG guidance, it is hard to measure sustainability performance, and the reason for this is a lack of common standards, particularly with the “S” and “G.” The “E” on the other hand, although still difficult, is much easier to measure.

The Economist report concludes that ESG, in its present state, is “neither a good measurement tool nor an effective risk-management one.” It’s too confusing, too far-reaching, and “bears little relevance to what a company actually does.”

It argues that ESG “is infected with moral judgments that change with the weather.” That’s why it is recommending the linking of the three to end. For those of us seeking companies achieving best practices in sustainability for investment decisions, The Economist argues it would be much simpler to make governments and regulators ask for reporting on total greenhouse gas emissions (cradle-to-grave) and make that a standard for guiding shareholders.

[…] one that has been in the news a lot lately. Recently, I published a posting on the subject based on The Economist’s conclusions about the current state of ESG as a standard by which investments are measured beyond the […]