January 25, 2020 – A hedge fund founded in the United Kingdom, The Children’s Investment Fund (TCI) has given publicly traded companies a directive: to disclose climate change-related risks.

TCI wants to know the carbon footprint of publicly traded equities, and the material impacts their greenhouse gas (GHG) emissions, will have on profits, sustainability, litigation, and physical assets.

In announcing its ESG policy, which stands for Environmental, Social and Governance, it has requested the following:

Emissions Disclosure

TCI requires the companies that it invests in, to publicly disclose carbon and other GHG emissions including targets for emissions intensity reductions and absolute level reductions. These disclosures are compulsory and should meet the standard established by the Climate Disclosure Standards Board, an international consortium of business and environmental NGOs.

Low-Carbon Transition Plans

TCI expects the companies in which it invests to institute credible, publicly-disclosed plans to reduce their GHG emissions. These plans should include measurable science-based targets aligned with the goals set by the Paris Climate Agreement of 2015, requiring full de-carbonization of the world’s economy by 2050.

Actions Required for a Low-Carbon Transition

TCI has tasked those companies in which it invests to:

- Reduce their carbon footprint through changed business processes.

- Introduce efficient energy management into their buildings, factories, and other infrastructure.

- Source low-carbon energy through purchase or through direct power generation.

- Decarbonize transportation by switching from gasoline and diesel-powered vehicles fleets to electricity or other non-polluting technology.

- Offset business travel emissions through the purchase and investment in reforestation, afforestation, and other natural carbon sequestration projects.

- Decarbonize company supply chains and help customers to lower their carbon footprints and carbon intensity.

- Advocate for government and industry regulation focused on decarbonization to ensure long-term sustainability.

TCI’s Riot Act

The investment fund has pledged to do the following:

- Vote against all directors of companies that do not publicly disclose their GHG emissions and do not have a credible plan for carbon reduction.

- Vote against auditors where Annual Reports and accounts fail to report material climate risks.

- Divest from companies that refuse to disclose GHG emissions and that do not have a credible plan for their reduction.

- Disclose to all investors votes and reports on ESG performance of the companies within the fund’s portfolio.

TCI Support of Mandatory GHG Disclosure

The investment fund wants all investors in publicly traded equities to join it in asking for mandatory GHG emissions disclosure and the adoption of credible low carbon transition plans.

Furthermore, the fund believes investors should influence such disclosure and GHG emissions management by voting against boards that hide such information from the public.

It also calls for the firing of investment managers who do not disclose a company’s carbon risk and GHG emissions.

Climate-Related Financial Risk Rising to the Forefront

Mark Carney, the retiring governor of The Bank of England, has been championing disclosure of carbon risk since 2015. His warnings to the business world have been largely ignored.

But recent events, the California wildfires of 2018, and the Australian bushfires have shown that companies and governments are in peril when they ignore carbon risk.

In an article appearing in today’s Report on Business, The Globe and Mail, Eric Reguly, the paper’s European Bureau Chief, describes how Carney first began highlighting the climate change risks to banks, insurers, and big companies. He stated that to avoid costly shocks like the one that happened to Pacific Gas and Electric (PG&E) after the California wildfire in 2018 when it saw its market value of $25 billion USD drop to $3 billion within two months, identifying climate risks should be a company’s highest priority. He called the sudden shock, a Minsky Moment, a reference to Hyman Minsky, an American economist who predicted that an economy can move from stability to mayhem almost instantaneously.

For PG&E the company found itself declaring bankruptcy after an incident in November 2018, when a near-century-old transmission line broke causing a wildfire that burned down the town of Paradise killing 85 and destroying 14,000 homes. PG&E didn’t take into consideration California’s drought conditions, and the risk to the rights-of-way for its transmission lines passing through forests that were dry as kindling. It wasn’t like the company didn’t have a prior warning. This was the 408th incident in 2018 where sparks from power lines caused a fire and was the 1,961st since 2014. Despite these forewarnings, PG&E didn’t use profits to upgrade its 30,000-kilometer (18,000-mile) network of transmission lines, but rather paid investors higher dividends.

Carney’s warnings became a reality, but the PG&E experience didn’t teach a lesson to the Australian government which in similar circumstances committed the same error in judgment. The federal government’s blatant disregard for climate risk in the face of a prolonged drought in the Australian Outback set the stage for the bushfires that are inundating millions of hectares (tens of millions of acres) in the country’s southeastern states. Instead of implementing climate change policies to ensure environmental sustainability, Australia’s government continues to promote coal.

Carney has entreated the financial sector to play a crucial role in solving the climate crisis. He has made four recommendations to banks, insurers, and other financial institutions that include:

- Integrating the monitoring of climate-related financial risk into investment decision making.

- Leading by example by making sustainability key to all investments.

- Collaborating to bridge the data gaps around climate-related risks.

- Building knowledge internally on climate risk and share it with stakeholders, and management.

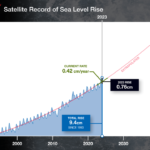

Carney in his call to action made this clarion remark: “As long as temperatures and sea levels continue to rise and with them climate-related financial risks, central banks, supervisors and financial institutions will continue to raise the bar to address these climate-related risks and to ‘green’ the financial system. We need collective leadership and action across countries and we need to be ambitious.”

Carney’s sojourn at The Bank of England ends on January 31, 2020, less than a week from now. But he hasn’t given up the climate change fight. The United Nations has asked him to become a special envoy to mobilize the financial world against climate change. In this new role he will build a common reporting framework for carbon risk. Carney told the BBC after accepting the new responsibility, “the disclosures of climate risk must become comprehensive, climate risk management must be transformed, and investing for a net-zero world must go mainstream.”