December 4, 2015 – The first week of the global climate change meetings in Paris is coming to an end and the jury is out on whether we will get agreement on lowering greenhouse gas emissions among the close to 200 nations attending. They all know the answer. It’s there before their eyes but no nation wants to lose any bit of its sovereignty through a binding global commitment to carbon reduction. They all know that a universal carbon tax is the best way to force transition from fossil fuel dependency to low-carbon economies.

Countries aren’t the only players attending the conference. Elon Musk of Tesla, SpaceX and Solar City has also dropped in and lent his voice to the proceedings. In a talk to students at the University of Sorbonne he states “The rules today incent people to create carbon. This is madness.” That only a price on carbon will get us to where humanity has to go to ensure the planet’s health. He further states, “If countries agree to a carbon tax….we could see a transition that has a 15 to 20-year timeframe as opposed to a 40 to 50-year timeframe.” Musk sees the lack of a carbon tax being equivalent to a plus $5 trillion subsidy to carbon emitters. The tax he envisions would be revenue neutral along the lines of what the British Columbia government in Canada instituted. Revenue neutral means money collected by the government through the tax is offset by lower taxes elsewhere.

Of course the myth makers argue that any price on carbon will do great harm to economies, reducing gross domestic product and increasing poverty. Carbon tax advocates state quite the opposite and can point to British Columbia as a working example. That Canadian province has experienced steady economic growth under a $30 CDN per ton carbon tax.

Today British Columbia is not the sole jurisdiction pricing carbon. More than 20% of governments worldwide have put in place some kind of carbon levy whether it is based on a trading system with industry imposed carbon caps, or a straight consumption or producer tax. In British Columbia the tax has had an interesting impact:

- Fossil fuel consumption has declined 17.4% per capita.

- It has allowed the province to impose the lowest income tax rates in the country.

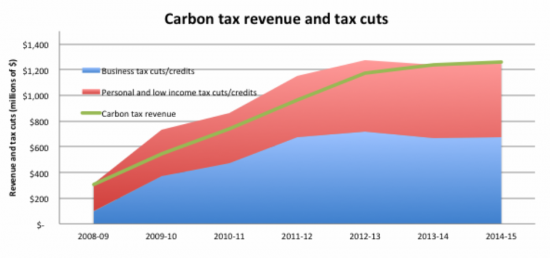

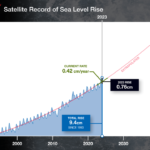

- The tax was revenue-negative in its first few years because the impact was five times greater than forecast (see graph below).

- Tax savings for consumers have exceeded carbon revenues by a half-billion dollars over the first 5 years since instituted.

The positive impact of the carbon tax has been a negative, a decline in fossil fuel consumption.

The positive impact of the carbon tax has been a stimulus to a build out of public transit.

The positive impact of the carbon tax has inspired the city of Vancouver and other localities in the province to offer rebates and incentives to householders and businesses to make energy efficiency improvements further driving down demand.

The provincial economy has outperformed the rest of the country since instituting the carbon tax.

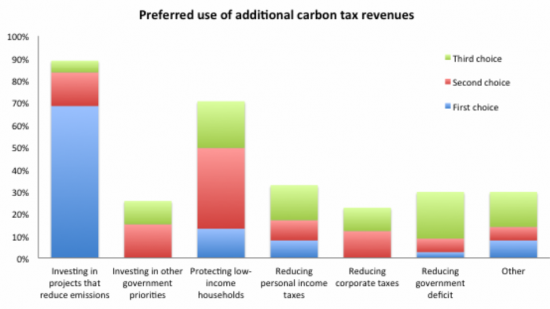

Recent polls show that 64% of British Columbians favour the carbon tax and 41% support its growing while 35% believe it should stay at $30 per ton. Only 14% think the tax should be lower. The debate these days seems to be on how to use the carbon revenue to speed up the transition and invest further in infrastructure.

So one wonders why all nations cannot see the benefit of pricing carbon. In the case of British Columbia the economy remains resilient while the province moves away from dependence on fossil fuel energy, in the process engages its citizens in a dialogue about how to move forward, and best of all lowers its carbon footprint.