February 4, 2016 – Back from Costa Rica where my wife and I spent the last two weeks enjoying a country and people who live by the slogan “pura vida” which translates from the Spanish to English literally as “pure life.” But in Costa Rica it has much larger meaning, a greeting that has been around for more than half a century that says something about the country and the optimism and hope of its people. Costa Ricans exhibit a sense of optimism that is infectious. And when you look at the picture below you’ll understand the many reasons for that optimism.

On a previous article extolling this country’s move to a wholly renewable energy model I talked about how Costa Rica is the first to become 100% fossil fuel free. What I thought at the time was that the country was using its advantages to produce lots of solar power. But I found out when I arrived there that for the most part the renewable energy is largely hydroelectric and geothermal. Only in recent years has wind been added to the energy mix. The lack of solar panels surprised me the most.

Why? Where we were staying, in the province of Guanacaste, the sun shines 12 hours every day from November until April. Locals told us the last time it rained here was in early November. Guanacaste is the dry northwest of the country which even in the rainy season experiences sporadic but often heavy downpours. The rest of the time it is sunny. When you consider the country’s location, within 10 degrees of the equator, using solar panels on homes would produce near peak efficiency from this energy source all year round. If every house in Costa Rica had roof panels the country would truly be living the “pura vida” life. The reason it hasn’t happened according to those I spoke with, is the cost of solar panels and installation is still considered too high. But prices are coming down so Costa Rica may soon become a large player in solar energy.

———-

But let’s talk about another source of energy and how it is being impacted currently and how it will be impacted in the future. We are talking about oil. Today recurring oil price shocks are causing energy companies to bleed red ink. The truth is these companies have yet to experience a more fatal blow than low priced oil. The next shock will be carbon taxes because that is what is coming down the fossil fuel pipe over the next half decade and beyond. With the world fixed on the guidelines coming out of COP21 a concerted effort to move to a low-carbon future will mean a whole new industry crisis with far reaching ramifications.

What’s so interesting about the current oil “crisis” is how purely it is a business play to drive the new oil producers out of world oil market with Saudi Arabia behind it. The cost of pumping oil in Saudi Arabia is negligible (sunken costs have long been recovered particularly in years when oil was at peak price). The Saudis fear new competition from the fracking revolution and improved technologies to recover oil from older wells in other countries.

The new ways of producing oil worked well when fossil fuel was priced at $100 U.S. It worked well for oil sands producers with their high overhead and production costs. The expansion of Alberta’s oil sands wouldn’t have happened without these high prices. But now the price has plummeted to around $30 because the Saudis continue to pump oil in record volumes saturating world markets. Hence this morning I paid $0.93 Canadian for a liter of gasoline at a full service station here in Toronto. Self serve was going at rates as low as $0.86 per liter. What I paid when translated into American gallons equals $3.00 U.S., a 50% drop in gasoline costs in the last year for the average Toronto consumer.

So other than the Saudis is anyone making money in the oil patch these days? No one, not even the Saudis. They are running up enormous deficits in their budgets to keep subsidizing their government programs. This is drawing on deep financial reserves to remain afloat. To continue this forever would be ruinous. For the moment, however, there is no end in sight to the Saudi strategy because new oil source competitors continue to operate.

But big oil’s days are numbered. Today universities and foundations divest from fossil fuel stock holdings. Soon the energy companies themselves will be seeking ways of mitigating their risky oil future. Marginal and unconventional oil such as that produced in deep water, in oil sands and through fracking will be far too expensive as carbon is priced and carbon trading goes global.

ExxonMobil recently predicted that energy demand globally will grow by 25% between 2014 and 2040. At the same time the company stated that the carbon intensity of each unit of energy will decrease by half during that same period. The report’s findings favour the continued predominance of oil and natural gas as energy sources which isn’t surprising coming from the same company that denied global warming was anthropogenic and tied to the burning of fossil fuels.

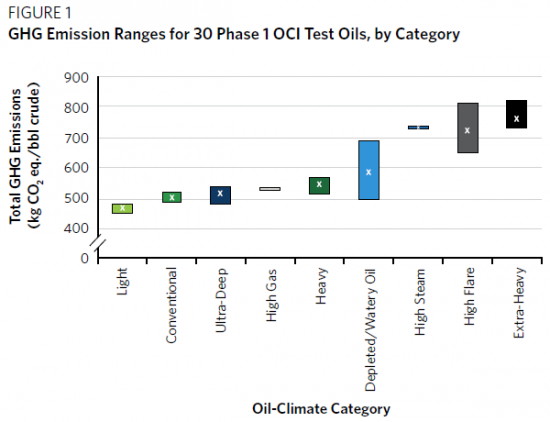

What is the current carbon intensity of a barrel of oil? Well it differs depending on the source. Take a look at the chart below to see just how much. Produced by the Carnegie Endowment it lumps 30 different oil types into nine categories with an 80% difference between the lowest and highest emitting crude sources.

The most carbon intensive is the oil produced by Suncor from Canada’s oil sands. The least intensive oil comes from Norway. Taking the most carbon intensive at over 800 kilograms of carbon per barrel of oil, imagine a carbon price at $30 per ton and the unit cost of that oil increases by $24. Now increase the carbon price over time to $50 or $100 per ton and suddenly oil sands product becomes cost prohibitive. At $50 per ton of carbon a single barrel will be taxed at $40. And at $100 the tax will be $80. Even if ExxonMobil is right in its forecasts that intensity will be cut in half, the premium an energy company will pay to produce a barrel of carbon intensive product will be burdensome. Now look at Norway light oil at under 500 kilograms of carbon per barrel. With a tax at $100 per ton within a decade or two, the cost of that low intensity oil will still face a penalty per barrel of close to $50.

So unlike the current crisis where oil companies are being challenged by low oil pricing on the world market, the next shock will be a series of increasing carbon tax costs that will effectively change the pattern of demand. When a liter of gasoline climbs to $4.00 U.S., translating to over $18 per gallon, how many consumers will continue to want to operate vehicles that run on gasoline?

[…] Oil Industry Facing Two Shocks – Falling Prices and Climate Change Action […]