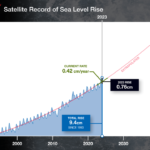

May 21, 2015 – This week in Paris world business leaders have gathered to talk about climate change and investment. Two months ago 266 large investors responsible for managing $20 trillion U.S. in assets included climate change in their strategic planning. Among these were a number of large banks. These financial institutions are responding to the need to transition to low-carbon economic alternatives to doing business as usual as a socially responsible act. At the same time they have become sensitive to the risk of remaining heavily vested in high-carbon businesses.

Among the organizations attending the Paris conference are Moody’s, Mercer, Accenture, Standard & Poors, MSCI, Solactive, Kepler-Cheuvreux, Mirova, Credit Agricole, Carbon Tracker Initiative, Asset Owner Disclosure Project, Council on Economic Policies, Global Footprint Network, New Climate, CO Firm, Ecofys, Beyond Ratings, UNEP-Fi, WRI, and IIGCC.

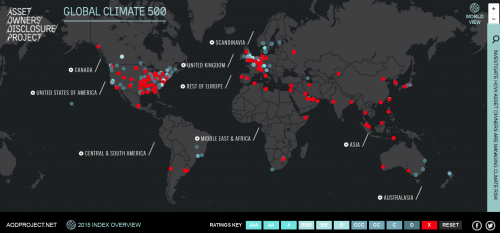

But these global low carbon leaders represent a small minority as many of the world’s largest investment firms continue to support high-carbon assets. In the most recent Asset Owners Disclosure Project (AODP), indexing the top 500 global asset owners managing $40 trillion U.S., 232 of them remained committed to high-carbon with no directive for investment into a low-carbon future.

As a retired person living off investment income I have been asking for full disclosure on my entire portfolio from my financial advisers. The bank to which my wife and I have entrusted our financial security is just beginning to address green and low-carbon businesses and this is happening to some degree because of social pressure from investors who read about climate change, stranded assets and the future.

AODP lists nine AAA best performers, all who measure climate change risk in portfolio decision making. These include by rank: Local Government Super (Australia); KLP (Norway); CalPERS (US), ABP (The Netherlands); Environment Agency Pension Fund (UK) New York State Common Retirement Fund (US); Australian Super; PZW (The Netherlands) and AP4 (Sweden). Note only one American and no Canadian asset managers make the list.

Julian Poulter, founder and CEO of AODP states, “People understand that governments will not regulate carbon properly but they now realise that these massive funds at the top our financial system have legal and financial responsibilities to manage climate risks.”

This third annual AODP report shows that business and the investment community still have a long way to go to make the paradigm shift to a sustainable low-carbon economic future. For example:

- 7% of asset owners calculate the carbon being emitted from their investments.

- 1.4% have reduced carbon intensity from the previous year but not necessarily total carbon output. Remember intensity is a measure of carbon output per unit of production so if an investment asset increases production the total amount of carbon may rise.

- 2% of asset owners have set a carbon intensity reduction target for 2015-16.

- No fund even those which have partially divested themselves, have calculated their fossil fuel total portfolio exposure.

So it would appear that we, the public, and particularly those who rely on investment income, have an ongoing responsibility to make our investment and pension fund managers aware of our concerns related to climate change mitigation and adaptation. The adaptation includes a responsible transition to a low-carbon economy through green and sustainable investments.