October 13, 2018 – Recently I was made aware of a GeoPhy dataset looking at listed real estate investment trusts (REITs) and climate change exposure risk. Based on rigorous and scientific assessment the dataset points to climate risk for the entire real estate sector.

The GeoPhy dataset is composed of projections of sea level rise, precipitation, heat stress, and extreme weather events like Hurricane Michael which this week struck the Florida Panhandle. The company behind GeoPhy is Four Twenty Seven, a market intelligence provider. They launched the dataset and a summary paper at last week’s Urban Land Institute meeting in Boston, Massachusetts.

Founder and CEO of Four Twenty Seven, Emilie Mazzacurati is quoted in a press release stating, “Real estate is on the frontline of exposure to climate change. Many valuable locations and markets are often coastal or near bodies of water, and therefore are going to experience increases in flood occurrences due to increases in extreme rainfall and to sea level rise. These risks can now be assessed with great precision …. to perform comprehensive due diligence which reflects all dimensions of emerging risks.”

A chief economist of GeoPhy, Nils Kok, pointed out some of the potential impacts that market is already experiencing from climate change risk. For example, in some parts of the United States, properties at risk to sea level rise are seeing a 7% decline in value according to a study done jointly by the University of Colorado – Boulder, and Pennsylvania State University, published in the Journal of Financial Economics.

Key findings from the GeoPhy dataset include:

- 35% of REIT properties globally are already exposed to climate hazards with 17% exposed to inland flood risk, 6% to sea level rise and coastal flooding, and 12% exposed to hurricanes or typhoons

- The largest at risk to sea level rise markets in the United States can be found in New York City, San Francisco, Miami, Fort Lauderdale, and Boston with the Top 3 U.S. REITs representing hundreds of billion dollars in what are certainly overvalued assets.

- In Hong Kong and Singapore alone, Sun Hung Kai Properties, a REIT worth $56 billion, has more than one-quarter of its properties exposed to potential coastal flooding.

- In Japan, some 37 REITs contain portfolios worth $264.5 billion, at high risk of exposure to typhoons.

Four Twenty Seven’s market risk scoring system applied to the GeoPhy dataset rated sites most at risk to climate exposure on a scale from 0 to 100 with anything at 50 or above deemed to be an exposed property.

- Floods – Properties scoring 50 or higher were sites that have experienced at least some flooding at a return interval of at least 1:500 (noting that Hurricanes Harvey, Florence, and Irma were all 1:1000 events). Any score higher than 50 indicated greater frequency or extent of flooding.

- Sea Level Rise – Properties that scored 50 were coastal sites below at or below 10 meters in elevation that were expected to experience disruptions due to floods. Sites with a score of 60 and up were already experiencing flooding or were likely to experience it by 2040.

- Extreme Weather – Properties scoring 50 or higher were sites that had experienced multiple Category 3 and up hurricanes (or recurring instances of tropical storms) in the past 35 years and were likely to experience more intense tropical storms, hurricanes or typhoons in the future.

- Extreme Heat and Drought – Properties considered exposed to water and extreme temperature stress, although not directly physically damaged were seen to have declining value because of these recurring conditions.

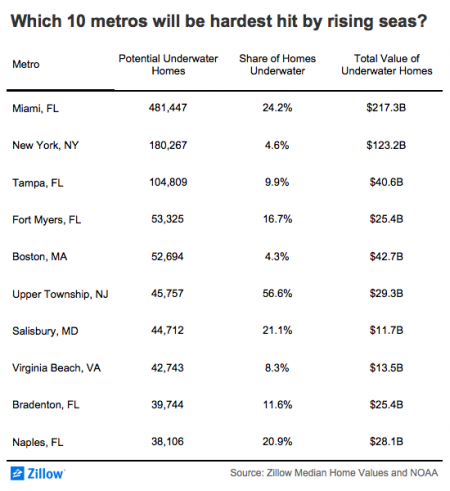

Are buyers of homes in vulnerable areas paying attention? Zillow Research in a recent report estimated that 1.9 million homes in the United States will be underwater by 2100 with losses estimated at $1 trillion.

Despite this, the post-Hurricane Sandy experience shows us that buyers’ memories are short, with the tendency for real estate valuation markets to return to normal when the last extreme weather event fades from memory.