June 22, 2020 – If insurance companies were to raise premiums or deny coverage to polluters, would it be a gamechanger for our planet? The Geneva Association is an international thinktank for the industry. It has published a guide for risk managers and investors that looks at what climate change is likely to impose on humanity in the near future. The guide is a compilation based on 62 interviews with senior executives in the insurance and reinsurance industry who were asked about their role and actions in addressing global warming.

Anna Maria D’Hulster, Secretary-General of The Geneva Association, states “no single industry or government can solve the climate change.” But I would argue that if any industry has the means to push forward a solution it is insurance. Although insurance companies like so many white-collar businesses, contribute through building infrastructure and operations some of the greenhouse gases (GHGs) that are the cause of atmospheric warming, it is in their role as underwriters and deliverers of insurance policies that they can dramatically impact climate change.

How so?

If an insurer is unwilling to accept the risk when a company applies for coverage, that can lead to a change in behaviour on their part. And if insurers collectively agree on what is considered unacceptable risk, then the company may not find any individual insurer willing to issue a policy.

As risk experts, insurance companies know just how much industrial pollution is contributing to rising GHGs and the attendant increase in extreme weather events that impact payouts to policyholders.

In the Geneva Association report it makes three recommendations:

- Governments, policymakers, standard-setting bodies and regulators across industry sectors need to work together to address key barriers that hinder insurers from scaling up their contribution to climate adaptation and mitigation.

- The insurance industry has to institutionalize climate change as a core business issue, expand its contributions towards building financial resilience to climate risks and supporting the transition to a low-carbon economy by collaborating

with governments and other key stakeholders. - Governments and the insurance industry need to explore ways to support climate resilience and decarbonized critical infrastructure through the industry’s risk management, underwriting, and investment functions.

Nowhere, however, does the document call on underwriters and policy issuers to say no to companies that are obvious climate change contributors. We are talking about the fossil fuel industry, shipping and transportation, and energy producers.

Insurers can in one fell movement pull the plug on entire sectors or subsectors. For example:

- Stop issuing policies to polluters like coal projects, oil refineries, thermal powerplants, and other GHG contributors.

- Create policy discounts to marine, air, and trucking firms who put low-carbon emission technologies into practice and disincentives through increased rates to those who don’t act.

- Similarly, incentivize thermal energy plants through significant savings on insurance if they implement decarbonizing infrastructures such as carbon capture and storage (CCS), or switching from coal, and oil to natural gas or hydrogen.

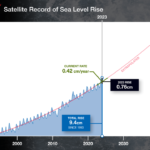

Does it require cooperation with government for the industry to do these things? I would argue, no. The industry knows that climate change is a material risk. The reinsurers have been tallying up economic losses decade by decade watching the dollar numbers grow with each extreme weather event or each millimeter of sea-level rise.

The question for all now is, “when will the tipping point be reached” forcing the insurers and reinsurers to get themselves out of bad long-term risk investments through their issuing of policies that act as a disincentive to action on the part of their customers to tackle global warming’s causes in their operations?