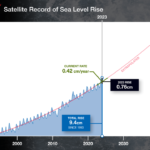

December 22, 2016 – Apparently the two are separable. Economies and carbon-based energy do not need to be in lockstep. Take these last two years. The global economy grew 6.5% while greenhouse gas emissions (particularly carbon dioxide) remained flat in the European Union and the United States and declined in China. These statistics point to a decoupling of national economies and their carbon emissions. They also point to the declining use of coal to generate electricity. For it is our economic reliance on coal as a source of power generation that represents the single largest contributor of human-generated emissions in the world today.

In the United States the declining use of coal and its replacement by natural gas, wind and solar represents the biggest contributor to declining emissions since the year 2000. During the period from 2000 to today America has grown its economy by 28% while carbon emission growth has peaked and begun to decline. In the United Kingdom between 2000 and 2014, the economy has grown by 27% while emissions have declined 20%. A quarter of European Union countries today no longer use coal to generate power. With President-elect Donald Trump promising to revive coal it would seem he is swimming against a tidal force of change with little thought to the long-term economic outcome. The future President needs to understand what most businesses, other than those in the fossil fuel industry, have already cottoned on to, that decarbonizing the economy can have significant positive impact. Increasingly businesses and those who invest in them see the transition to a low-carbon future as a positive. They see that cutting emissions can help to reduce operational costs. They see targeting emissions as an important way to improve the sustainability of their operations and supply chains. And they see low-carbon as an economic opportunity, a way for them to find new ways to make profits whether in the production of green goods or the provision of green services.

Why are businesses keen on carbon reductions? In a 2010 survey of 300 global companies with annual revenue exceeding $1 billion U.S., 82% reported taking action on energy. One reason was to find a way to become more energy independent. Putting solar panels on acres of rooftops was seen as a potential pay off over a 10 to 20 year period. Retrofitting infrastructure was seen as a way to reduce energy use. Between 2014 and 2015, 1,209 companies reported carbon savings to their shareholders. And 1,763 companies reported 23% internal rates of return-on-investment (ROI) from emission reduction projects applied to industrial processes. Among U.S. companies internal rates of ROI were as high as 81%.

More companies today are setting climate change targets. 53 Fortune 100 companies have reported savings of approximately US$1.1 billion annually through emissions reduction and renewable energy initiatives. In another survey 78% of companies reported carbon intensity or absolute emission reduction targets. The vast majority of these indicated they were working on 4-year timelines. Of these reporting companies, they achieved CO2 reductions from operations equal to 596 million tons. By comparison that amount matched Australia’s greenhouse gas emissions in 2012.

Corporate carbon reduction targets increasingly are accompanied by carbon pricing mechanisms. Even ExxonMobil has set an internal carbon price of $60 per ton for its carbon emissions from operations. In a recent study 517 companies reported setting an internal price on carbon and 732 indicated they were considering it in the near future. The price varied from as little as $1 to $700 per ton. If the private sector is buying in to carbon pricing as a means to measure sustainability over the long term, then one can argue we are well on our way to achieving a low-carbon economic future.

It all makes sense when you start thinking about it. Businesses see the efficacy of addressing climate-change risks. It is financially prudent to act to ensure future viability. When they seek to insure their operations, the industry that underwrites their operations, that bets against future disasters, is telling them that they are prepared to issue policies with a caveat — climate change risk exposure must be addressed.

In a report produced by The Global Commission on the Economy and Climate, it states, “The trend to reduce emissions and improve climate resilience has created major opportunities on which growing numbers of businesses are capitalizing. The global low-carbon and environmental goods and services sector was estimated to be worth around US$5.5 trillion in 2011–12, and to be growing at over 3% per year, making it more than 10 times larger than the global pharmaceutical industry. It is an increasingly global sector: international trade in environmental goods and services totals nearly US$1 trillion per year, or around 5% of all trade.” It, therefore, would appear that business is getting ahead of government, and the enactment of low-carbon policy, because it sees managing climate change as a growing market opportunity.

Is business acceptance of climate change and the enactment of carbon reduction strategies occurring fast enough to help mitigate the worst impacts of global warming? Not yet. But there is growing concurrence among business leaders that moving faster to get us to zero emissions and a negative carbon balance is in the best interest of the economy and the planet as we approach 2017 and beyond.