September 15, 2016 – In the last decade human ingenuity has produced the technology necessary to move from our massive power distribution networks to local community power generation and delivery. We have developed wind turbines, solar photovoltaic panels, wave and tidal power and battery storage systems that combined can replace coal and natural gas-generated electricity distributed over power lines that span thousands of kilometers and require substations and a complex infrastructure to maintain. This system favours large utility companies over small, local producers. And government regulation reflects the existing energy delivery system. That’s about to change.

One of the problems large utilities face trying to adapt to the changes brought on by rooftop solar and renewable energy power generation is how to track the energy flows. For example, if a home has solar panels and battery storage it may feed surplus power back to the utility company, reversing the meter tracking energy flow. Even electric vehicles could feed back power to the grid and the utility company that owns it. Utilities dealing with this paradigm shift have to account for customers’ power contributions, something they never had to consider in the past. Similarly a building or building cluster can install solar rooftop panels that let them become self-sustaining power generators, keeping the lights, heat and AC on without using any power generated by the utility. What does that leave a Con Edison? They like other utilities facing this paradigm shift still need to be connected to customers that may no longer need the power they produce, and at times they need to pay the customers for contributing power back to the grid. It’s more than just a revenue loss issue. It’s an accounting one as well. And that’s where blockchain, which I have recently written about is proving to be the technology of choice.

To handle the complex nature of power input and output and who bills whom and how much, a blockchain cloud-based general ledger seems like the right technology for the times.

In an article this week appearing in Bloomberg Technology, authors Anna Hirtenstein and Weixin Zha, write, “Utilities are shifting away from a century-old arrangement where they monopolized both supply and distribution.” This changing business model is leading these companies to look to blockchain to create “more nimble and decentralized” transaction systems. The world of distributed energy needs a new accounting tool. New York City based LO3 Energy is a company developing a number of community-based microgrid projects, local energy networks that can operate on their own when power failures occur in the larger power grid. In one project, the Transactive Grid, a combination of software and hardware is used to buy and sell energy automatically using smart contracts and blockchain. Surplus energy produced locally spins meters in reverse and tracks the energy and its value providing an accounting for every watt.

Joining LO3 are companies like Vienna-based Grid Singularity and Finland’s Fortum who are trialing blockchain-based platforms for buying and selling energy from consumers to utilities and back.

States Michael Liebreich, chairman of Bloomberg New Energy Finance, “the old system of a few big power plants and vertically-integrated utilities didn’t really need blockchain.” But a decentralized, high-volume transactional evolution to community-generated power and microgrids requires systems capable of handling the information about diverse energy flows.

“Blockchain doesn’t mean the end for utilities, but their role will change,” states Axel von Perfall, Senior Manager at PricewaterhouseCoopers AG.

Lawrence Orsini, founder of LO3 believes energy flows will be the largest user of blockchain technology in the end. He states it will be “larger than financial services by several factors….The world runs on energy. It doesn’t run on money.”

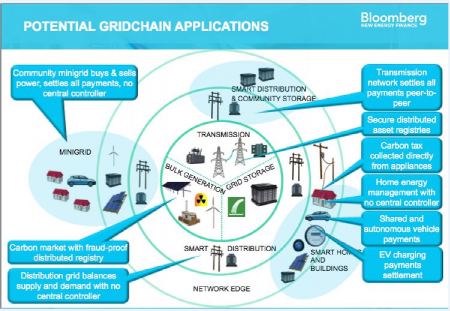

Bloomberg has aptly named blockchain for power, Gridchain. The infographic below shows exactly what Gridchain is all about, a world where where power is no longer just centrally produced and distributed.

I think that the shift to distributed power will eventually be a large part of our power system. Even if costs are slightly higher than grid power, there are a set of benefits that will be nudging us towards it: 1) The resiliency that distributed power brings means that an Ice Storm event isn’t going to be debilitating to you or your city; 2) for an individual, once your investment is made, you will have a known cost for your power that can make it tempting as a long term investment; 3) some people appreciate the self-sufficiency idea and some people just want to “stick it” to giant corporations, so this would be encouragement for them. There are several others, but you see the point. Even at a slight premium, distributed power can sell.

Your article brought something that I hadn’t thought about: the effect on capital investment, and it has some important effects. If this happens quickly, the existing capital that is sunk into infrastructure will have a reduced return, causing some heartburn for those investors, as these are typical amortised over long periods of time. The other problem is where the new institutional capital will go. Currently power investments have been large and long term, so large players like pension funds and institutional investors have been happy to put cash into known returns.

What happens when new infrastructure plans don’t materialise? Where will that money go. It will certainly free up billions of dollars and these people are going to have to deploy it. I have no idea that that will do to financial markets, but something’s going to go sideways when that extra money needs a new home.