Brian Wallace is becoming a regular contributor to 21st Century Tech Blog. He is the President of NowSourcing and a columnist for the Grit Daily as well as a contributor to CommPro. I like publishing his articles not just for the words but also for the neat infographics he produces. Credit scoring has always been a bit of a mystery to me. It is as much factual as interpretive. A credit score can be the difference between getting or not getting a loan or mortgage.

When Brian submitted this article to me I asked him if there likely is to be a replacement for credit scoring as the world moves towards eliminating money as the measure of wealth and medium of exchange. He replied that eventually it may come to that in the future but until then credit scoring is with us. so enjoy the read and infographic and please feel free to leave your comments.

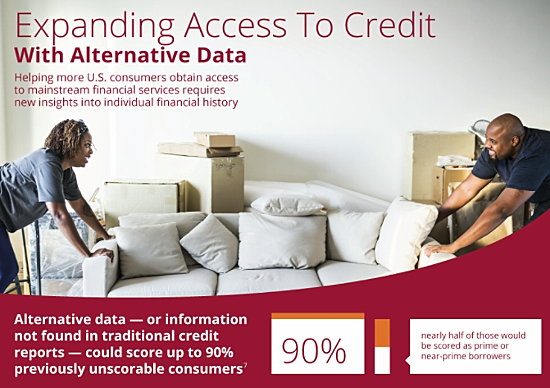

Securing and maintaining a high credit score is one of the most important things any individual can do to balance their financial security. However, for many there simply isn’t enough credit history to get started. In fact, in the United States, one in five don’t have a credit history to build upon, and traditional credit reporting doesn’t include some bill-paying data needed for creating a score.

People who fall under the unscorable category are most often those who are young or new to credit, new immigrants, recent widows or divorcees, racialized minorities, or those who use mostly cash or debit cards, among other things. It doesn’t mean any of these individuals are financially irresponsible. And the scoring doesn’t include things like payment of rent, utilities, and telephone. So, even if a person is paying every one of these bills on time, traditional credit scoring doesn’t take that into account.

This is already bad news since credit scores are looked at for some of the biggest purchase choices we make in life. Things like buying a car, buying a house, even applying for a job, or applying for rental property, all frequently rely on taking a credit history into account as an indicator of a person’s character and financial responsibility.

All of these credit-based choices, however, aren’t the only problem. With poor or no credit an individual will have to pay the highest interest rates and will be subjected to the use of high-priced financial services in the event of an emergency. Things like check cashing services and pawn-shop loans often become more of a burden than a blessing. People in this category can find it very difficult to break through the barriers they face when it comes to building any kind of credit score for the future.\

There is a solution to this problem, however, and it’s a fairly simple fix to level the playing field and take a greater portion of an individual’s financial history into account. It is the inclusion of alternative data for credit scoring. This would mean that 90% of those who are currently unscorable would finally have sufficient data to be able to receive an accurate score. Not only that, but nearly half of those who don’t meet credit scoring criteria would be able to meet prime or near-prime borrowing terms. This would help individuals become credit visible and allow them to build a solid financial portfolio. It would also be better for society because it would add an underrepresented group to the category of creditworthiness and promote increased economic activity.