September 23, 2015 – In 2015 437 companies so far have factored carbon emissions in their financial planning. That is triple the number in 2014 and speaks to the growing awareness in the corporate global community of climate change and its causes.

In North America the number of companies assuming a price on carbon has risen to 97, double the number from the previous year. And companies are not just following the guidelines of the states and provinces in which they reside. Where carbon is priced at $15 a ton in Alberta and $30 in British Columbia, some energy companies are doing financial planning that forecasts carbon to rise from $65 to $125 a ton in the near future. Enbridge for one has forecast a future in which carbon pricing will reach $200 per ton.

It is expected that another 583 companies plan to join the existing ones in the next two years creating internal carbon pricing whether governments choose to implement a carbon tax or not.

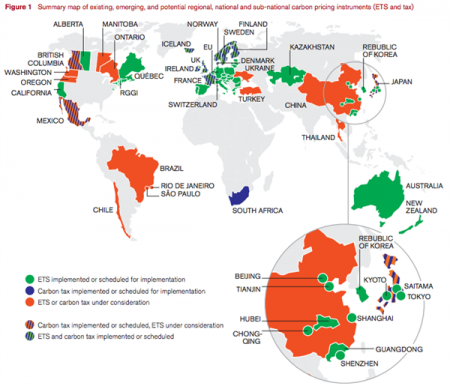

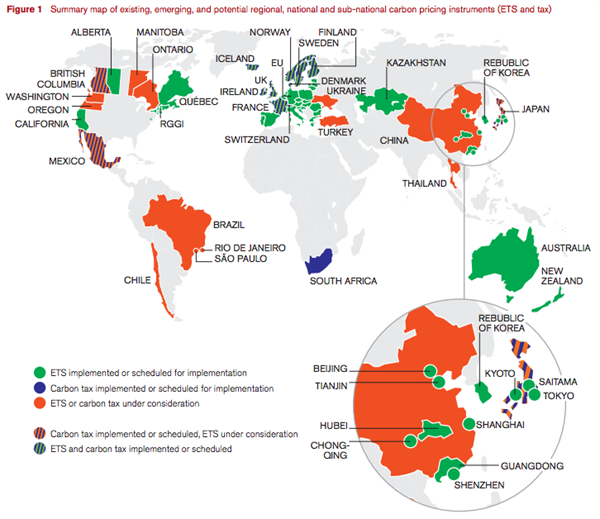

What is interesting is that the companies are ahead of countries in recognizing that carbon needs to be priced. Carbon taxes have yet to be adopted by most national jurisdictions even though the Paris climate talks are just a few months away. Those that have some form of levy at the national level include Costa Rica, South Africa, Denmark, The Netherlands, Norway, Slovenia,Switzerland, Ireland, Chile, Sweden, Finland, the United Kingdom, and New Zealand. India levied a tax on coal in 2010, not on carbon. it amounts to 50 rupees a ton which is inconsequential. Carbon cap and trade systems have been implemented in California, Quebec and in the very near future Ontario.

The European Union has also instituted a cap and trade system but not all European Union countries have instituted carbon floor pricing. So it seems that corporations acting in their best interest and that of society are beating governments to the punch.

Mind you not all. Here are three exceptions.

Exxon-Mobil – in the latest revelations it has been disclosed that Exxon knew about global warming and the role fossil fuels played in creating it based on internal research dating back to 1981. Yet the company chairman recently mocked climate models as unreliable in his most recent message to shareholders. Internally Exxon puts a price on carbon. They just speak out of both sides of their mouth when looking at their role as a fossil fuel producer and the relationship this has to global warming.

Royal Dutch Shell – has produced internal documents for business guidance in which the company forecasts a 4 Celsius (7.2 Fahrenheit) global temperature rise and intends to operate within this context. Shell has been given permission by the American government to drill for oil in the Arctic and the company sees nothing wrong with continuing business as usual with no thought of consequences. Shell too has put a price on carbon, $40 per ton, but it seems the company has no concern about its actions in contributing to global warming through aggressive exploration and exploitation of remote fossil fuel sites. It seems totally incoherent to be pursuing more fossil fuel development knowing the accepted 2 Celsius limit that the world is attempting to achieve isn’t even a thought for Shell.

British Petroleum – is known in Europe as the climate policy wrecker, lobbying the European Union at every chance to stop any action on climate change. BP is described by some as being the strongest advocate for “dirty energy” and opposed to any carbon levies. BP has pushed the European Union to scrap renewable energy and energy efficiency targets. It has pushed natural gas as the answer to Europe’s energy needs while trying to stop the expansion of wind and solar projects. And BP internally has adopted a $40 a ton carbon price. It just doesn’t seem to want to acknowledge that with pricing should come action to reduce carbon emissions.

All three of these companies use carbon pricing as a project means test – whether future investments remain profitable if and when they pollute the air. Not exactly corporate social responsibility.