When you want to get a business picture of the impact of climate change then one of your best sources is the insurance industry and the reinsurers who underwrite policies issued by the former. Among the two largest in the latter category are Munich RE and Swiss RE. Both understand the financial implications of climate change and devote a considerable amount of research into the subject.

Insurers are really licensed bettors. They figure out the odds associated with the risk to themselves of paying out to clients more than they take in from the revenue derived from issuing policies. Knowing the odds is the difference between profit and loss.

Reinsurers provide financial backing to insurers so that they can issue policies. These are big companies floating hundreds of billions of dollars. For them, they want to know the facts regarding the risk they are underwriting.

Munich RE employs a battery of climatologists and econometricians to help them understand risks from flooding, tropical cyclones, thunderstorms, tornadoes, winter deep freezes, wildfires, droughts and heatwaves. They are out front in trying to analyze and report on anthropogenic climate change impacts, differentiating them from events that occur through natural climate variability. Their research is among the best in the world in illustrating what global warming is doing to us. It shows rising levels of financial losses associated with human-caused changes. In covering the growing risk the company is inventing new reinsurance solutions that come at a rising cost.

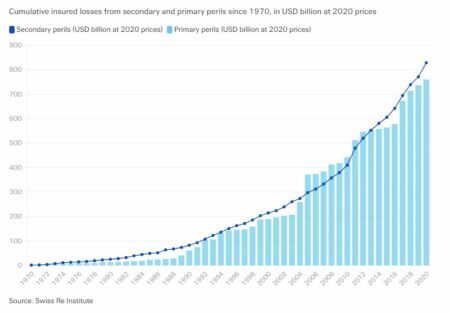

Swiss RE is in the same boat as the aforementioned reinsurer. The company has been documenting climate change risks. On its website it provides five charts that highlight losses and perils from extreme weather events, wildfires, floods and droughts. One chart, in particular, illustrates the growing annual losses in billions of US dollars from 1970 to 2020. The upward is particularly revealing.

In a revealing article published by Inside Climate News, Georgina Gustin describes the climate change financial risks US farms are facing. She argues that the banks that underwrite US farmers appear to not be looking at the data reinsurers are collecting and as a result appear to be ignorant of the peril that lies ahead.

Gustin interviewed a citrus grower from Southern Texas named Dale Murden, who after the Texas deep freeze that occurred in February described the experience to his farm as a St. Valentine’s Massacre (the infamous Chicago mobster event in the 1920s). The damage to his grapefruit groves was devastating exacerbated by a preceding withering drought in the previous summer. Murden stated that in over 40 years hehad never experienced anything approaching conditions like these.

He isn’t alone. Extreme weather has battered US farms and ranches for several years, the last two in particular. The words “frequency” and “intensity” keep coming up in the descriptions of various weather events that have impacted the American agricultural sector. And although government subsidies and programs have mitigated some of the financial losses being felt, farmers are feeling the global warming heat. But the banks that are their primary lenders seem to be ignorant of a foreseeable catastrophe.

The US Federal Reserve recently noted the financial risk to the banking system from the agriculture sector. It noted that both crop and livestock production equally face acute climate risks. Agriculture depends on nature: rainfall, groundwater, soil conditions, temperature, humidity, and more.

As an example of climate change impacts, in 2019 the US Midwest saw devastating floods. Farmers were unable to keep up with repayments with the Federal Reserve Bank of Chicago reporting that 69% of borrowers were falling behind financially. This is not an isolated case. The megadrought that has hit the US Southwest is having similar impacts on farmers elsewhere in the country as well as around the world. A recent United Nations report stated that globally natural disasters have increased 300% in the last 40 years with agriculture bearing the brunt of the financial damage.

In North America, US farmers are not alone. Canadian farms, particularly those in the Prairie provinces are seeing global warming impacts in the form of extreme weather events. The Canadian Prairies are home to more than 80% of the country’s agricultural lands, and have been subject to unprecedented summer temperature increases, higher than in any other region of the country. Natural Resources Canada reports that this type of extreme climate change is imposing much greater risk in both the present as well as coming decades. States Danny Blair, Geography Professor, at the University of Winnipeg, “there’s a lot of warming still to come.”

But have Canadian banks been any more prescient about farm risk than those in the US? Canada’s central bank has been studying physical and transition risks. But Canada’s Big Five banks still seem to lag in their understanding of what lies ahead in terms of potential loan defaults from the agricultural sector as the 21st century unfolds.

So if banks whether US or Canadian see more farms go under what will that mean to the stability of their respective country’s financial systems? What will it mean for long-term farm credit? We are talking about tens of billions of dollars annually to pay for seed, equipment, fertilizer, and more. And when these farms fail, what happens to food security?

The immediacy of the risk is understood by reinsurers who note that global climate change is locked in for the foreseeable future. We are talking about decades ahead just based on the warming to date. McKinsey & Company in its analysis of climate change on the agricultural sector predicts a substantial destabilization across North America. For banks, the hazard and risk from climate change cannot be ignored as profits vanish from loans to exposed farms.

What should the banks be doing? They need to do what the reinsurers have done. They need to dedicate resources and money to researching climate change. They need to develop climate-specific stress tests to fully understand the risks going forward. And they need to work with farmers on programs to ensure best practices in mitigation and adaptation are being implemented to lessen their financial risk exposure.